SMM April 24 News,

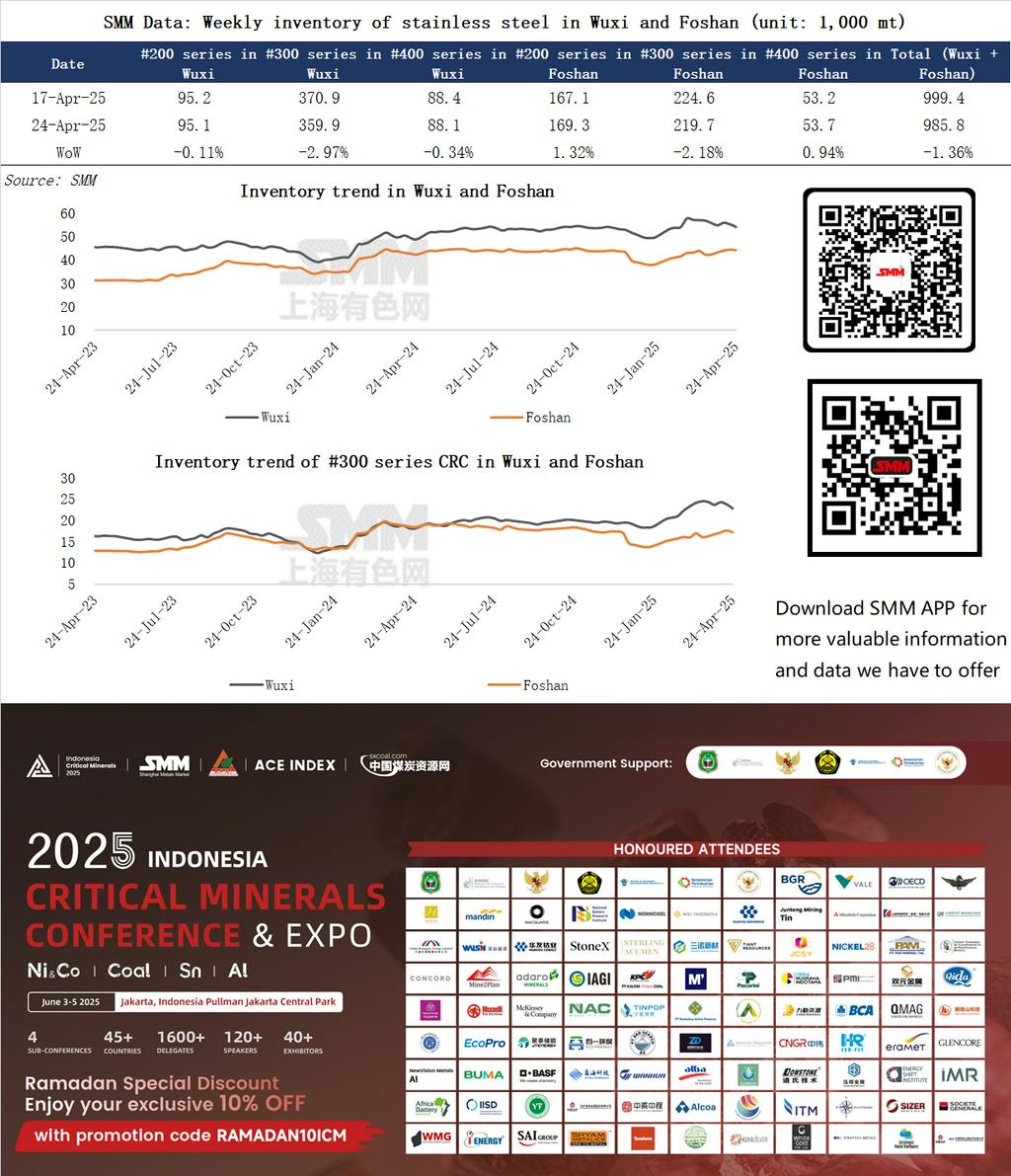

This week (April 18-24, 2025), the total stainless steel inventory in the Wuxi and Foshan markets showed a destocking trend, decreasing from 999,400 mt on April 17, 2025, to 985,800 mt on April 24, down 1.36% WoW. Demand side: Market demand remained relatively stable, with downstream enterprises maintaining a certain pace of cargo pick-up.

Supply side: Stainless steel mills actively urged agents and traders to pick up goods, but due to the high inventory levels previously maintained by agents and traders, coupled with significant pressure on warehousing and financial turnover, their enthusiasm for picking up goods was not strong, keeping market arrivals at normal levels. Stainless steel mills hoped to accelerate shipments, while agents and traders cautiously picked up goods based on their own business conditions.

Wuxi saw a destocking trend across all categories, with 300-series inventory decreasing significantly by 2.97%, mainly due to a large destocking volume of nearly 20,000 mt in delivery warehouses such as CMST and Minmetals, related to concentrated pick-up or delivery demands from some enterprises. 400-series inventory also slightly decreased, down 0.34% WoW; 200-series inventory changes were relatively small, down 0.11% WoW, maintaining a relatively balanced supply and demand.

Foshan's 200-series and 400-series inventories increased by 0.94% and 1.32% WoW, respectively, due to increased arrivals and slow downstream pick-up; 300-series inventory decreased by 2.18%, with significant destocking in delivery warehouses. The increase in 200-series and 400-series inventories was mainly due to recent increases in arrivals, while downstream pick-up was slow. On one hand, some steel mills increased shipments to the Foshan market, hoping to expand market share; on the other hand, some small and medium-sized enterprises downstream, due to financial constraints and uncertainties about future market price trends, adopted conservative procurement strategies, picking up goods as needed, leading to inventory accumulation. 300-series inventory decreased by 2.18%, with significant destocking in delivery warehouses, likely due to some large local processing enterprises concentrating on picking up goods from delivery warehouses to meet order demands.

SMM analysis suggests that the current market inventory is in a destocking state, which to some extent accelerates the capital turnover of traders, but due to the fierce competition and frequent price fluctuations in the stainless steel market, traders' profit margins are limited. As the Labour Day holiday approaches, some downstream enterprises may moderately restock considering production needs during the holiday. However, exports of downstream and end-use products face pressures such as uncertainties in overseas market demand and trade barriers, while domestic demand is also affected by the macroeconomic environment and the real estate market, making the situation still not optimistic. Additionally, the industry is about to enter the off-season in May, and overall market activity may decline, all of which will affect the subsequent destocking speed.

Next week, stainless steel inventories in the Wuxi and Foshan markets are expected to remain stable with slight fluctuations. On the demand side, pre-holiday restocking demand may be released to some extent, but explosive growth is unlikely; on the supply side, stainless steel mills may moderately adjust shipment pace and production based on current market inventory and demand, preventing significant inventory changes.

For any inquiries regarding stainless steel, please contact Yang Chaoxing at 021-20707860 or 13585549799 (WeChat same number).

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)